Role

Lead Product Designer

TEAM

2 strategists and 4 designers!

Date & Time:

Moody's Analytics:

CreditLens

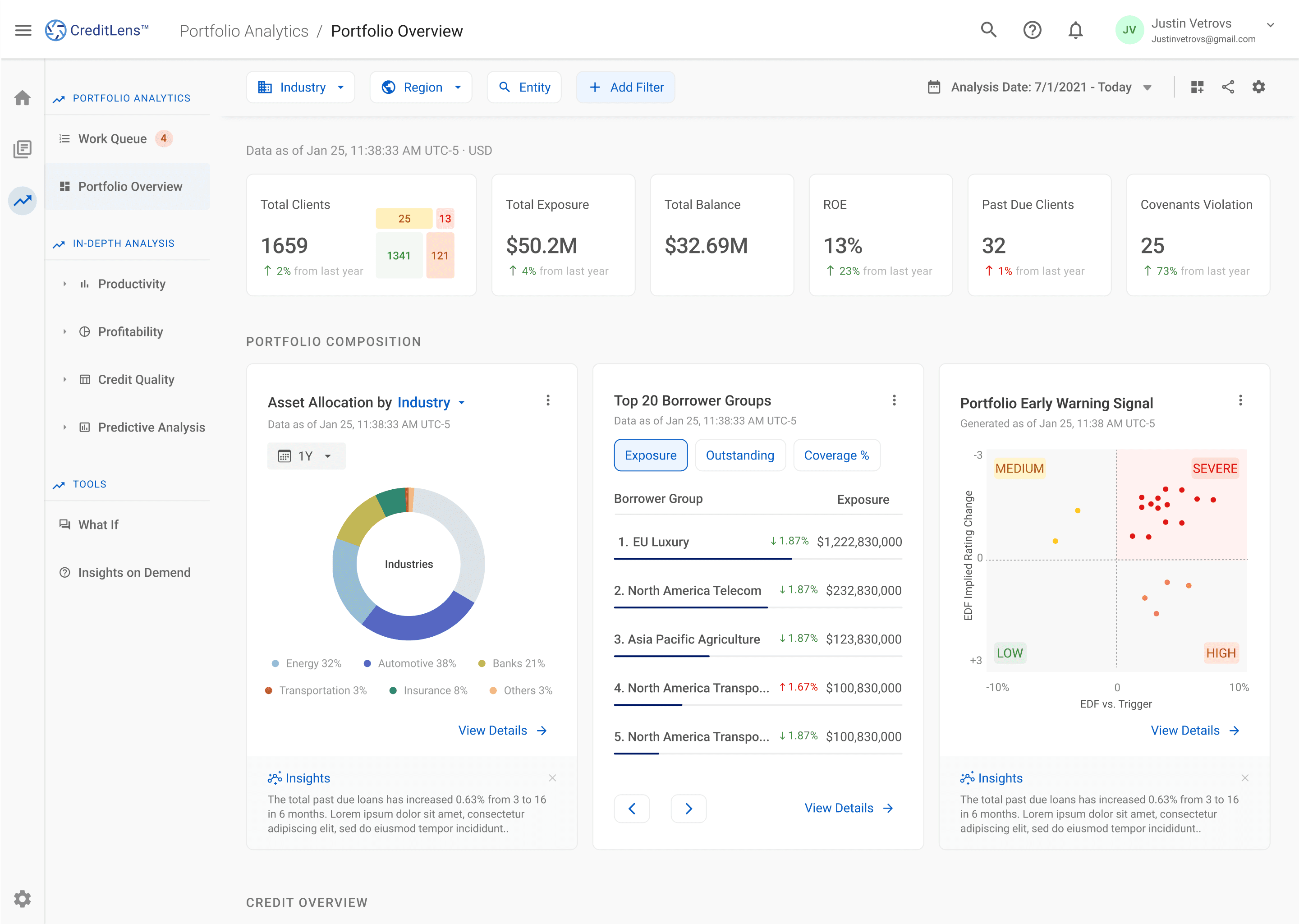

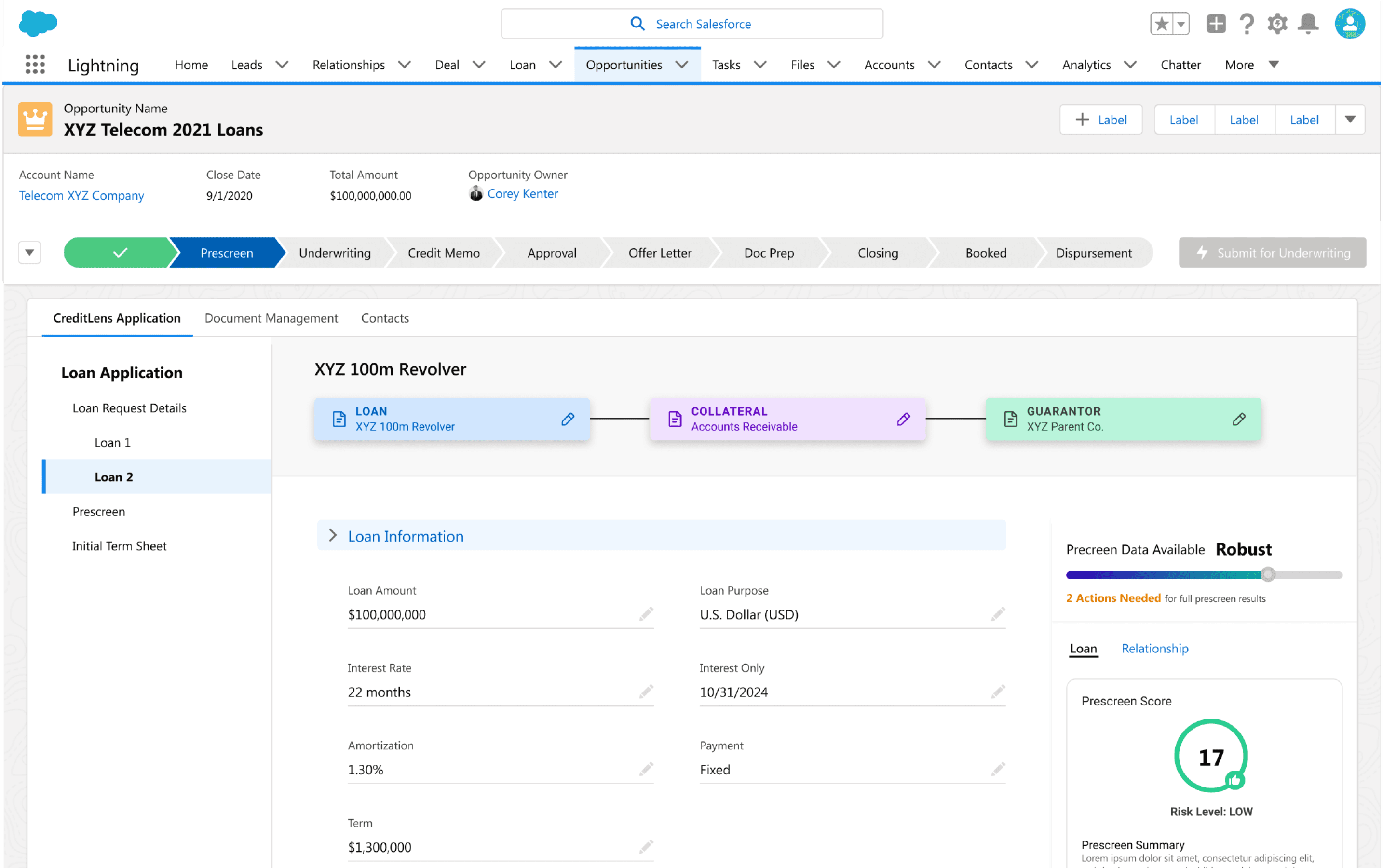

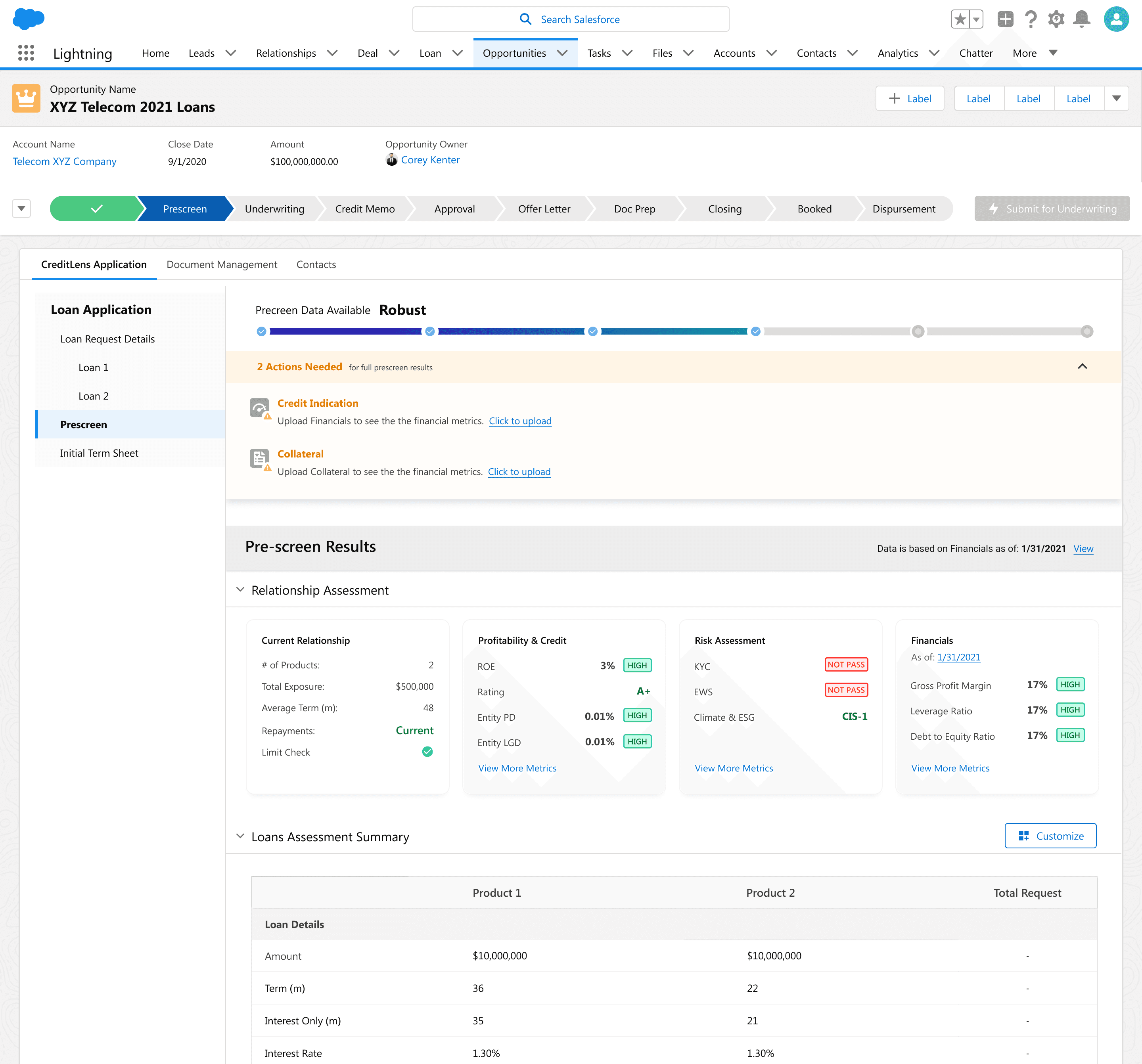

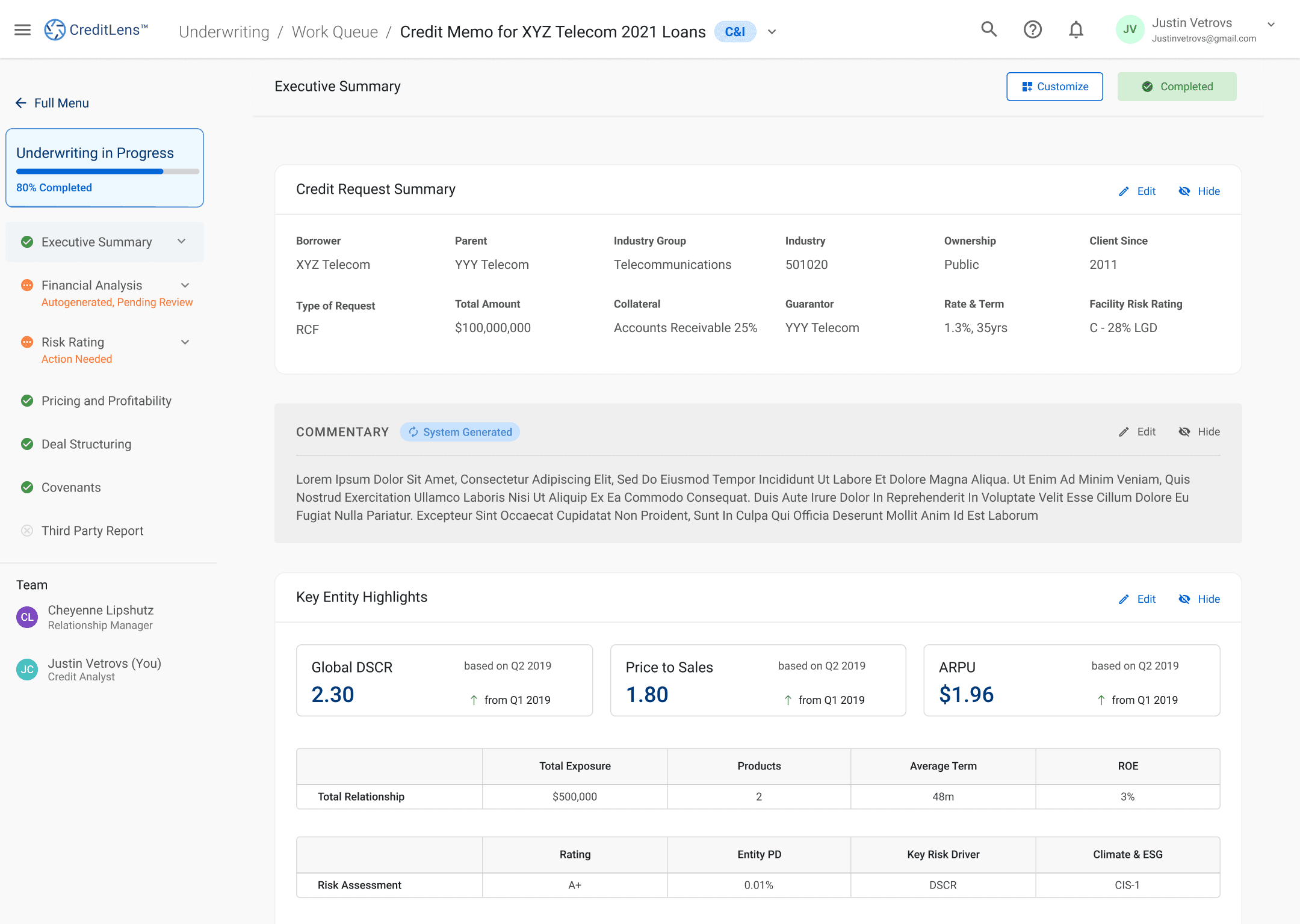

In 2021, Moody’s Analytics launched a large-scale redesign of their premiere lending product: CreditLens - a risk assessment tool used by banks to make better informed lending decisions. I was the lead designer in a team of 6 designers and strategists tasked with: introducing new technologies, improved usability, and smarter workflows to make the software a more competitive “end-to-end” lending solution in a rapidly evolving marketplace.

Collaboration

Project Management

Stakeholder Alignment

Rapid Prototyping

Business Growth

How the process felt ⬆️ 😅

RESEARCH & DISCOVERY

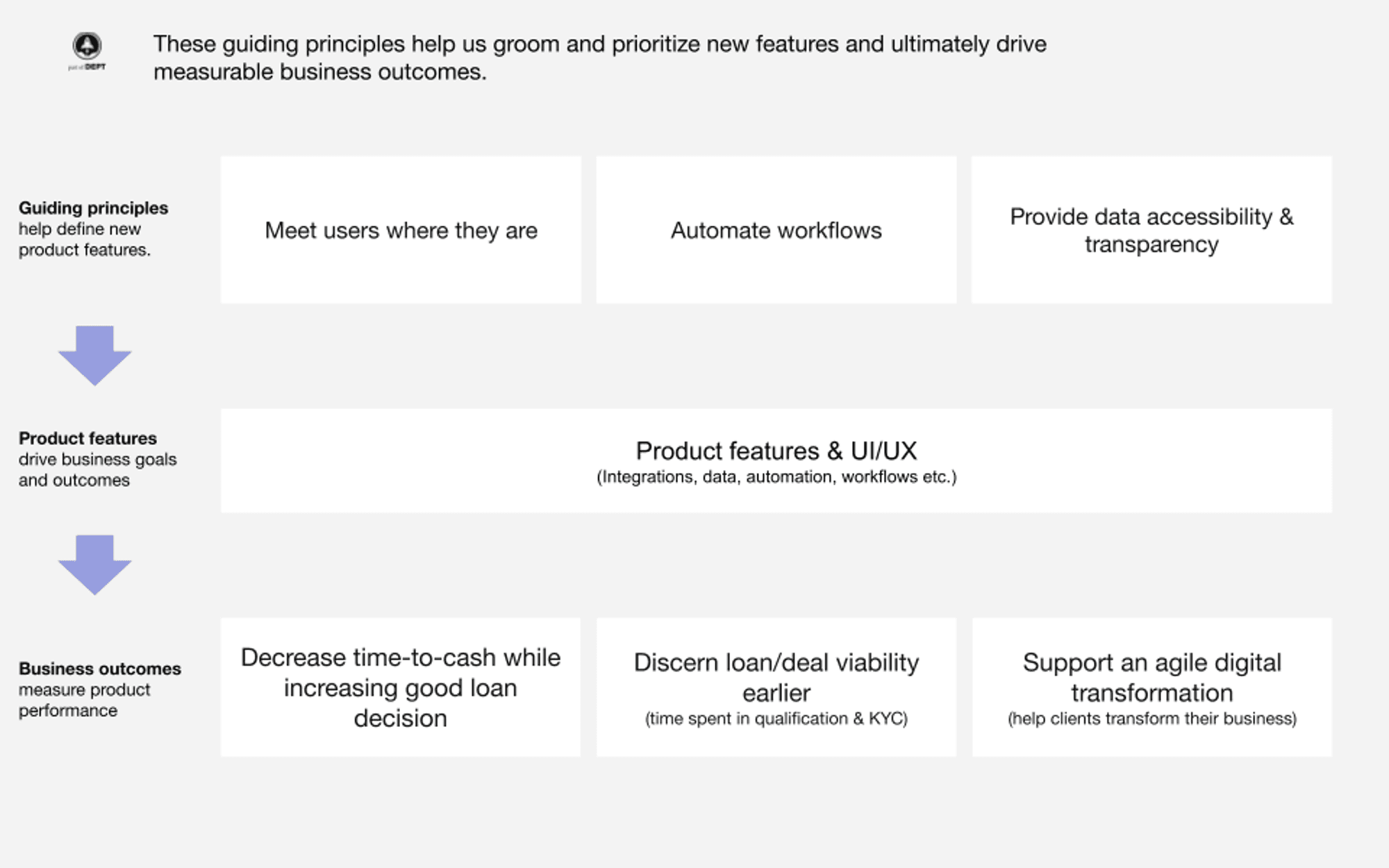

Through continuous customer interviews, we identified objectives and product features that balanced user needs with business outcomes.

We found there are many different roles that touch and move loans forward from origination to loan approval. — What are their goals and steps? Where do they intersect?

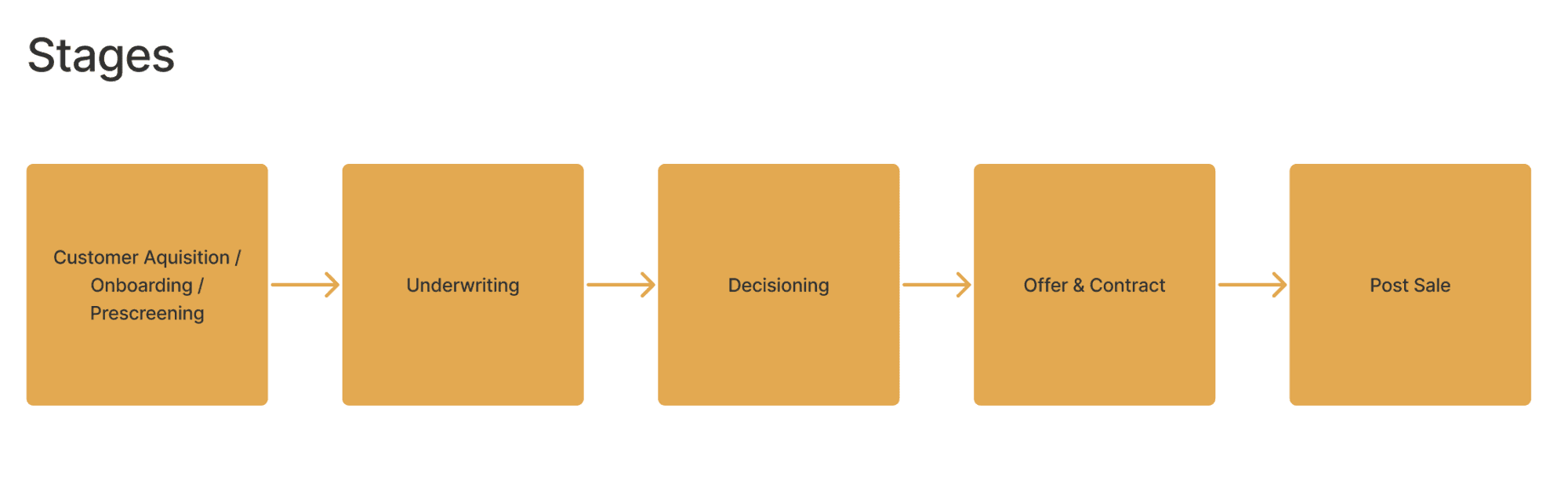

Journey Mapping & Opportunity Mapping

Taking what we learned to complete the bigger picture of the existing journey - helped us clearly see how these roles and steps intersect to complete the loan process.

As we completed the existing journey map and moved from synthesis into ideation, we looked for the answers to:

💡Ideation:

💡Ideation:

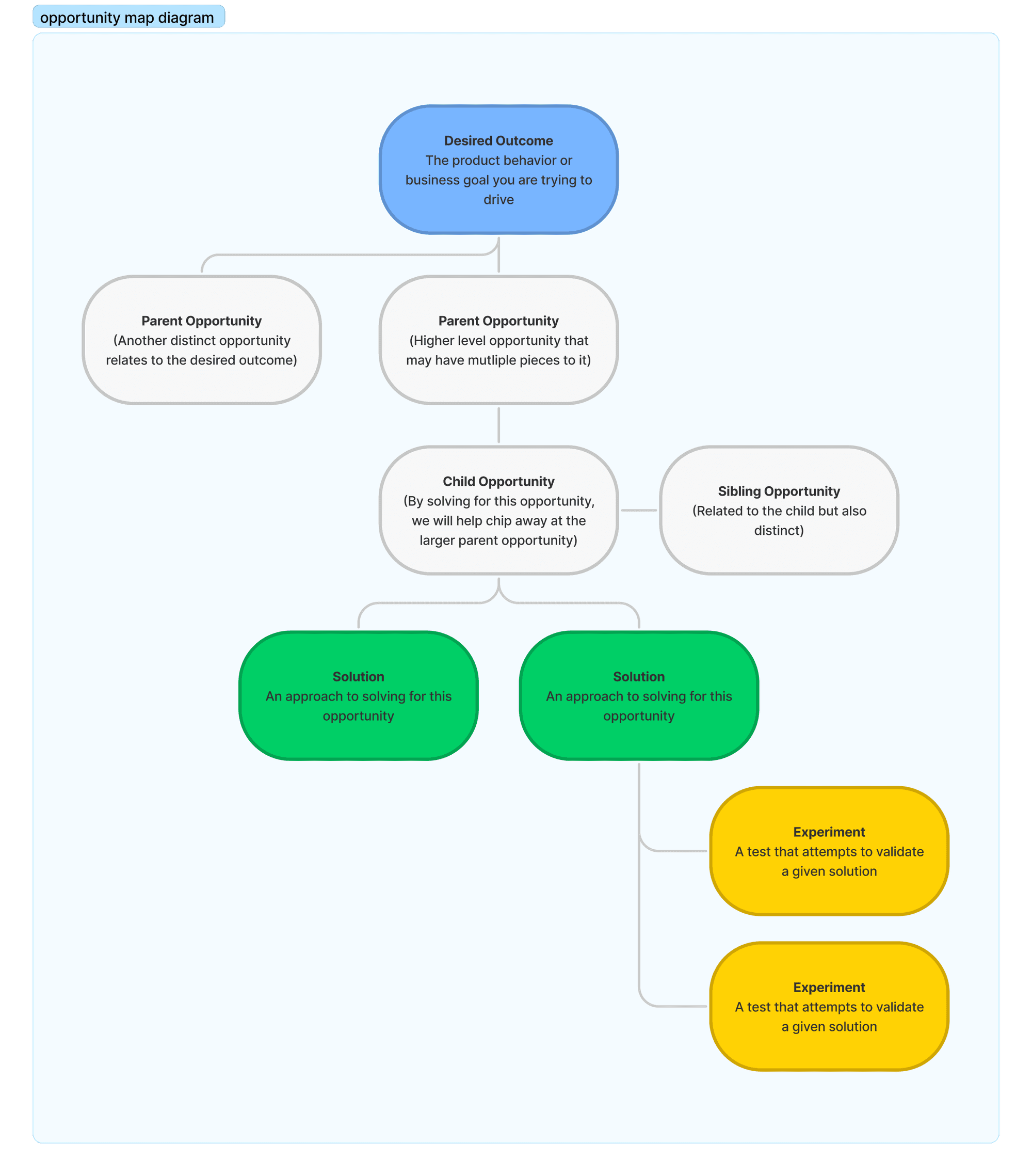

We then created an opportunity map: identifying opportunities that address one or more of the business goals across all stages of the lending journey.

DESIGN TIME

We created a user-first vision with 360 degree view of an improved experience by storyboarding from the point of view of our 2 core persona segments and use cases.

… This became the guiding light: Our new visionary journey

⭐ Storyboard

1️⃣

C&I Use Case

“A Tier 1 bank in the US is processing an application for a secured - revolving credit facility ($100mn revolver), from an telecom company of $800mn annual revenue.”

2️⃣

SME Use Case

“A Tier 2 bank in the US is processing a $900k secured - loan request from a manufacturing company ($15mn annual revenue). The manufacturing company is a new client and applied for financing through the Bank’s digital engagement platform.”

Bridging the gap with existing CreditLens…

⭐️ We gathered customer pain points and conducted heuristic analysis for improved usability.

THE SOLUTION DESIGN:

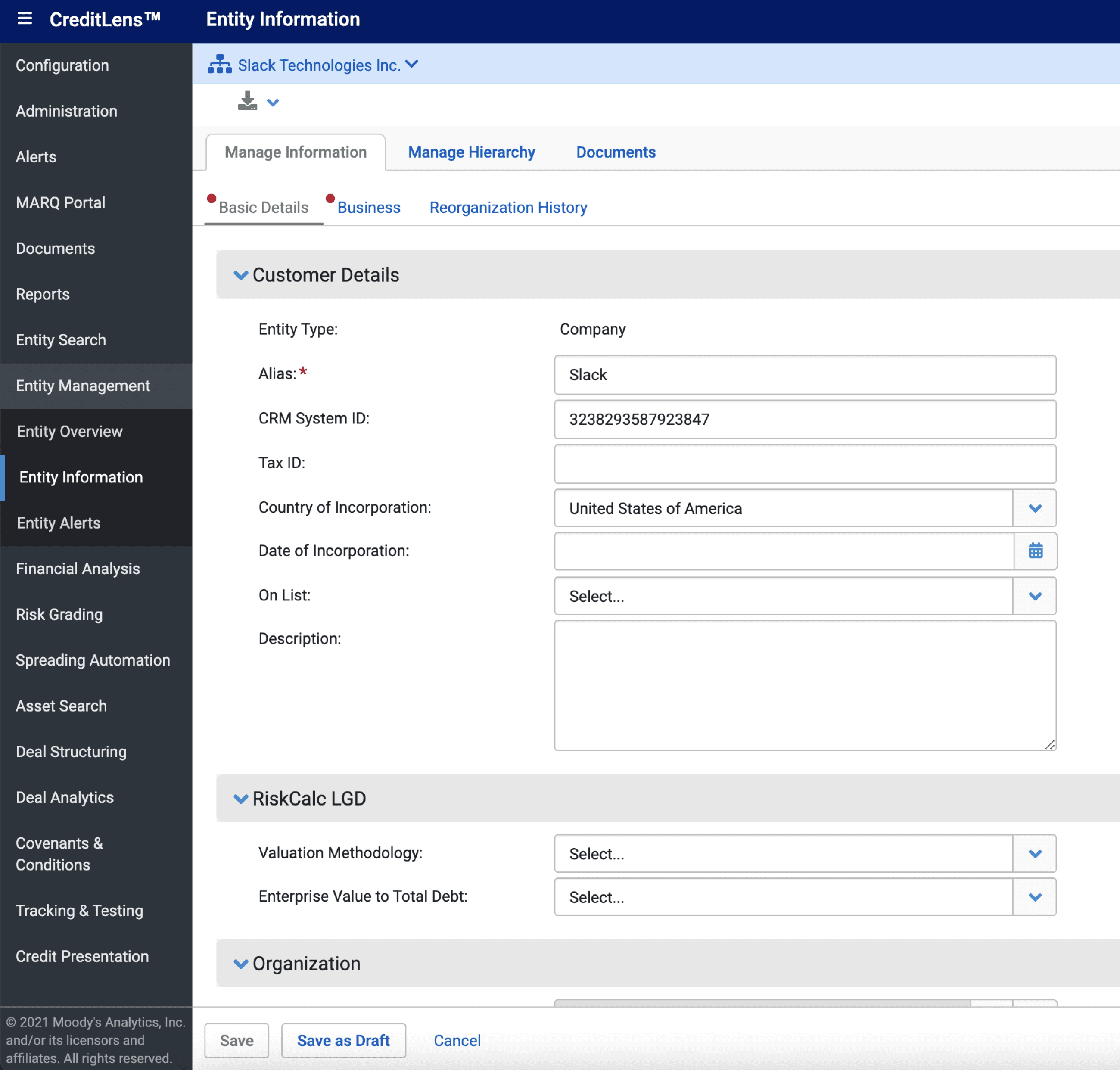

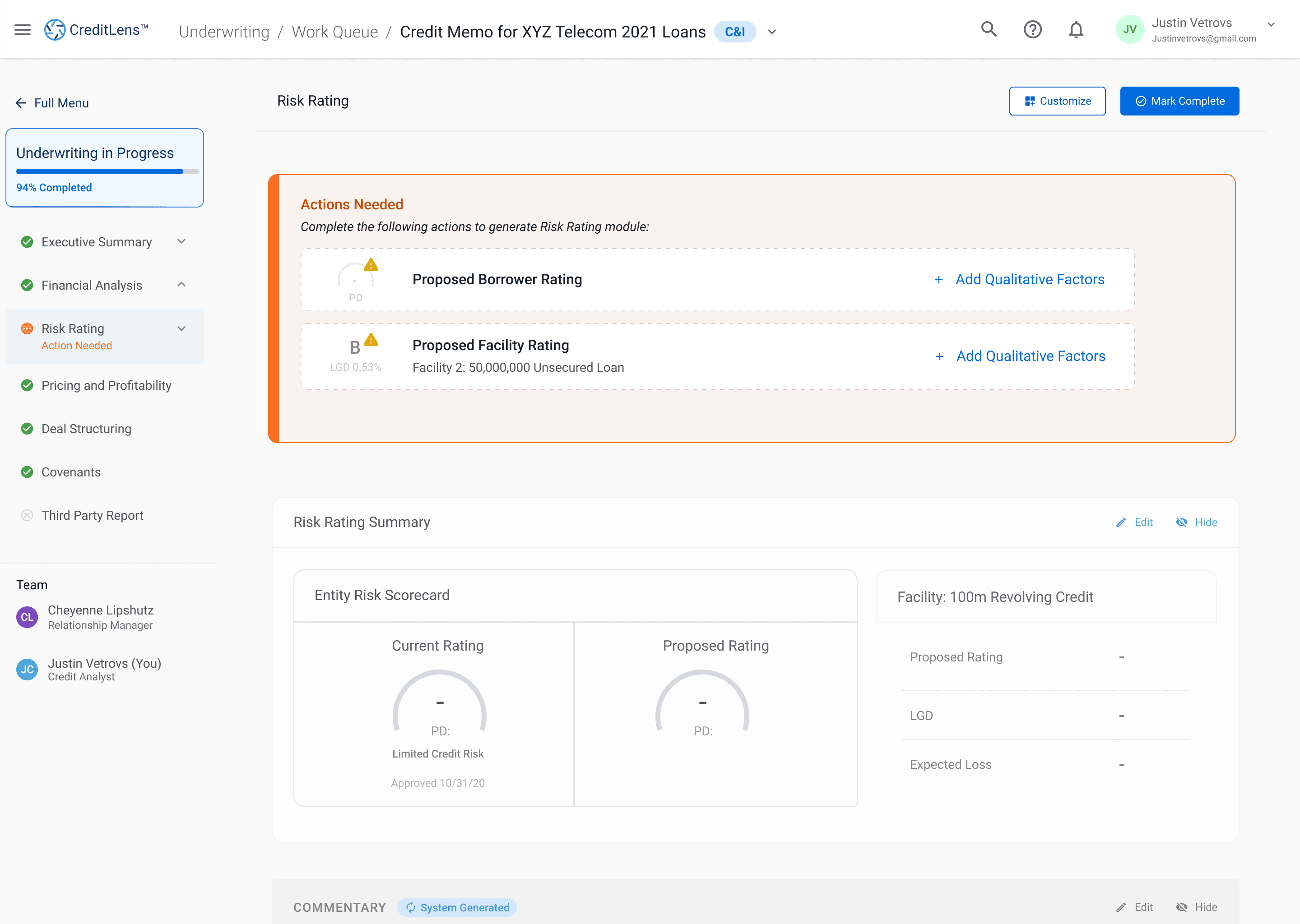

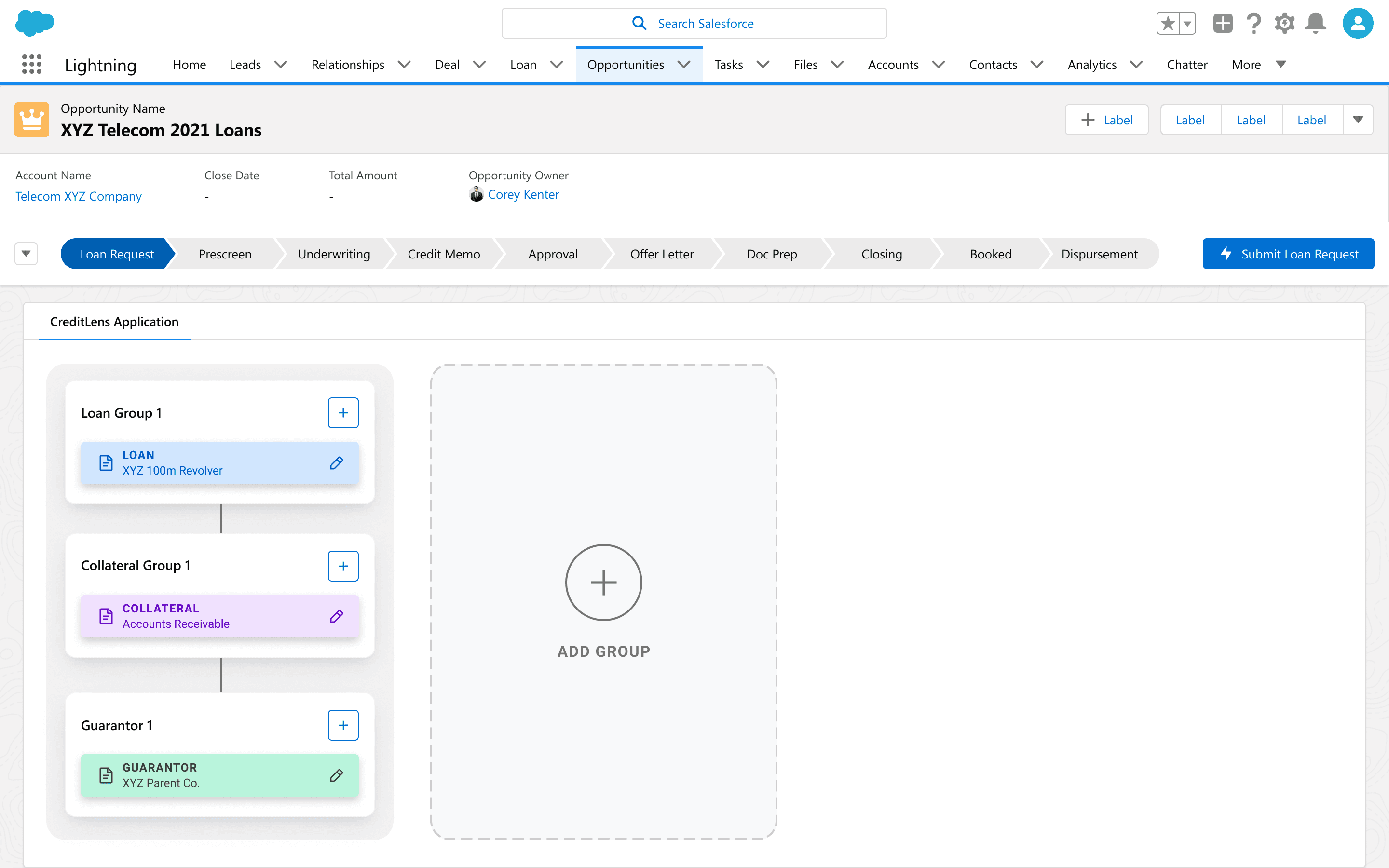

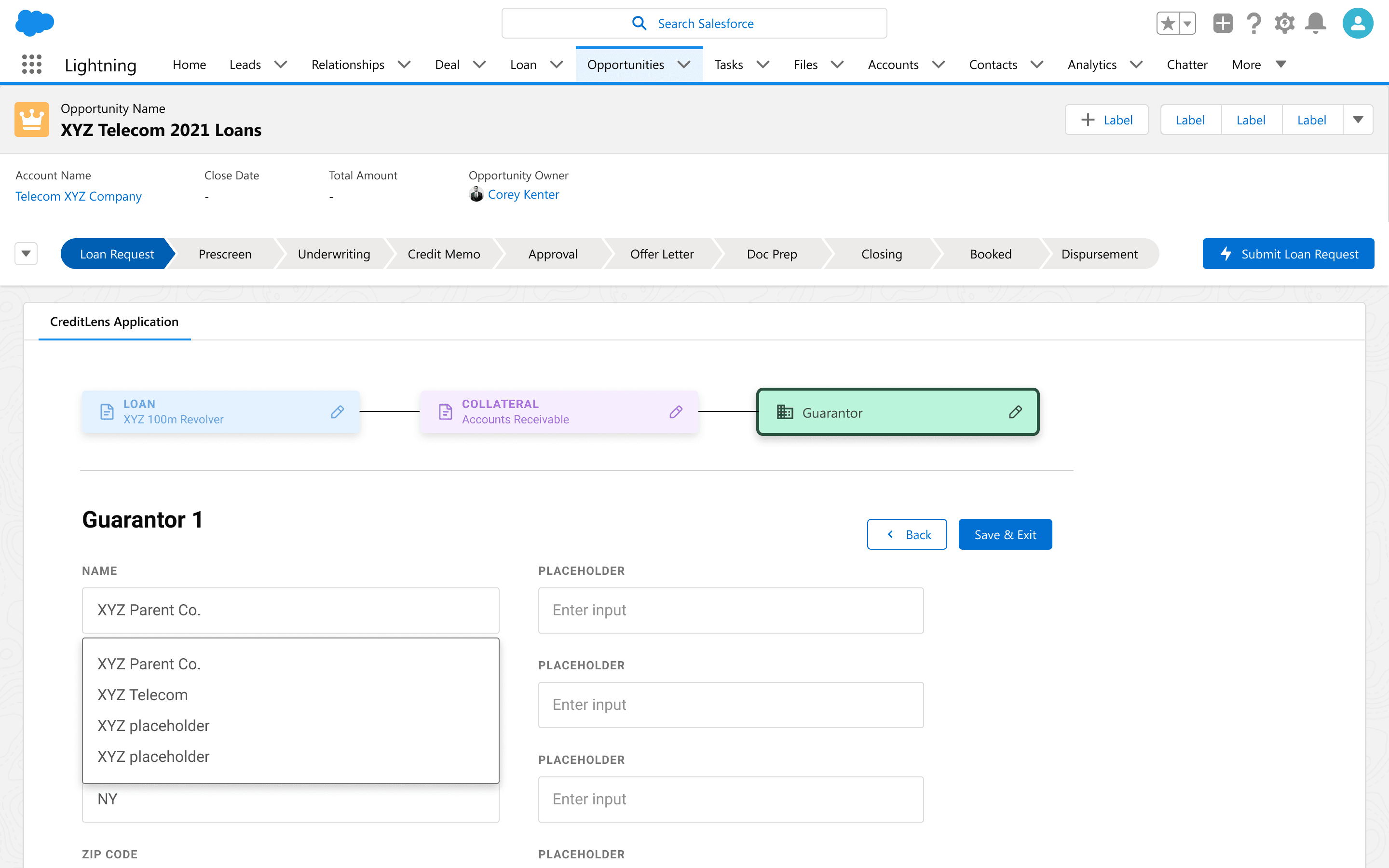

We addressed user needs and pain points uncovered through our discovery process and heuristic analysis design audit to arrive at the following solution addressing:

How Might We introduce new efficiencies when loans move through the process to different cross functional roles (i.e. relationship managers, underwriters, loan committees)?

How Might We decrease time to cash while increasing trust and good loan decisioning?

01

02

03

01

Meet Users Where They Are

Each persona interacts with the Lending Journey at different points and with different objectives. We should meet users where they are across the value chain by integrating with the tools they already use, catering UX that focuses on a persona’s specific tasks, and providing adaptive interfaces for different devices.

02

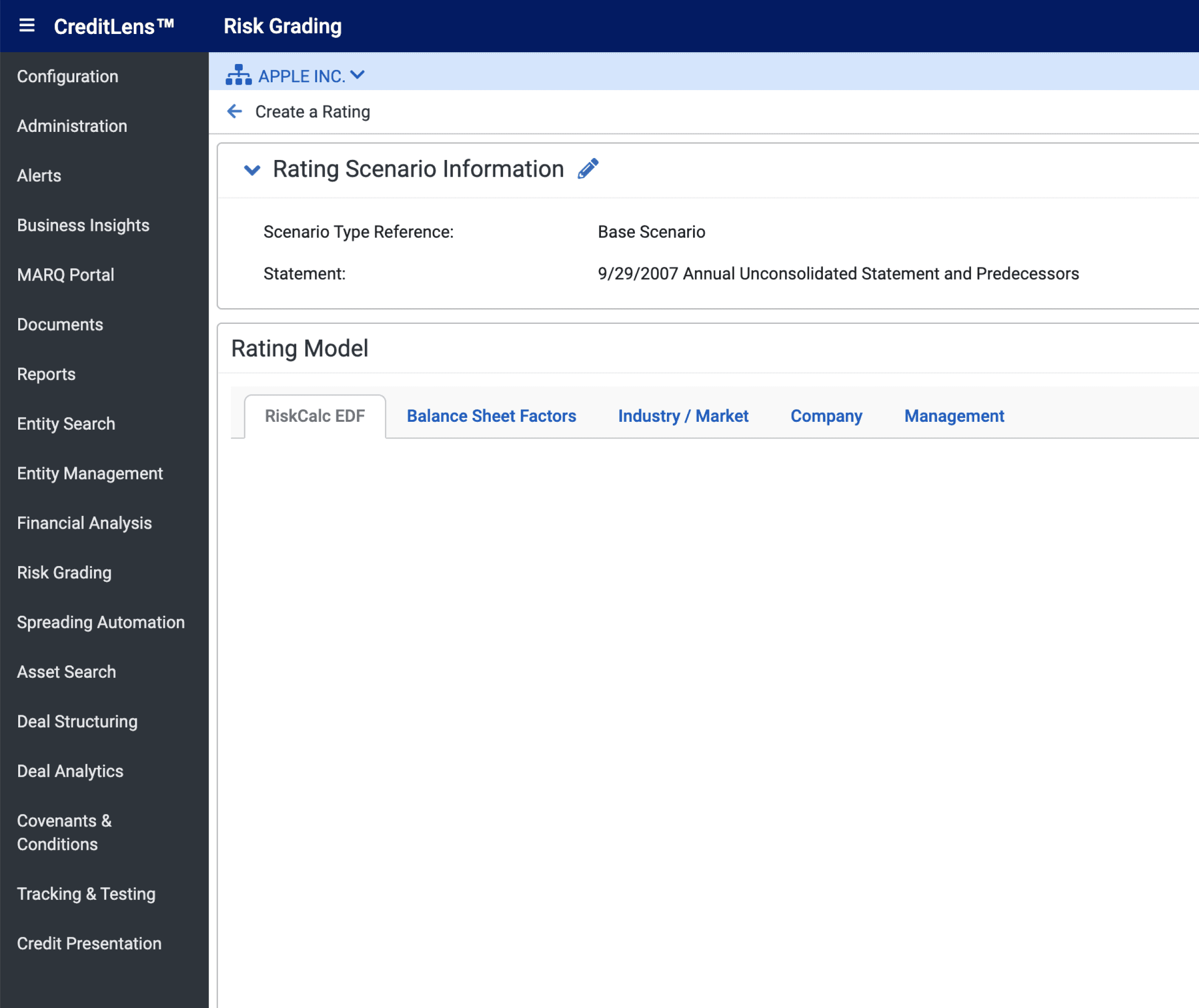

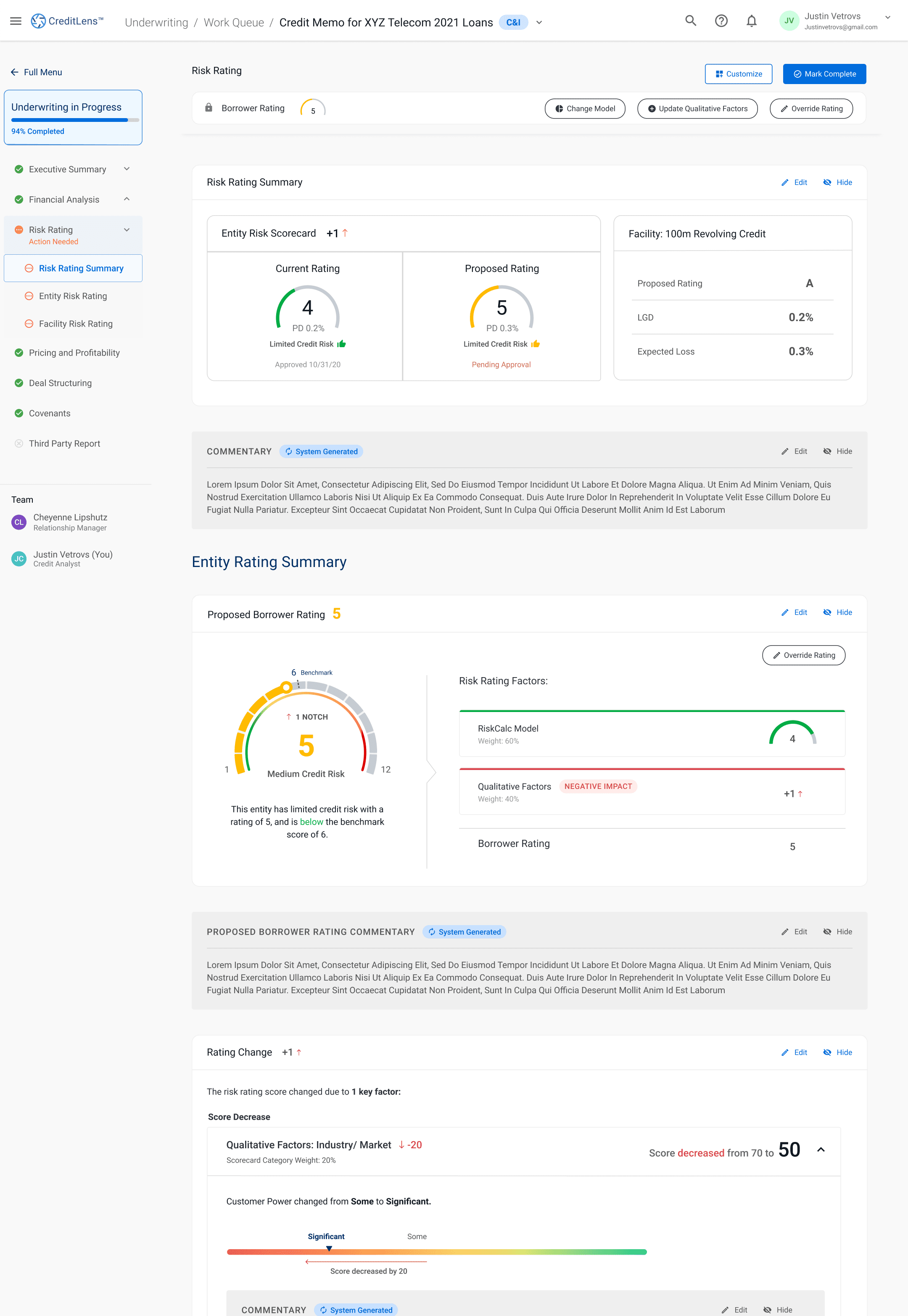

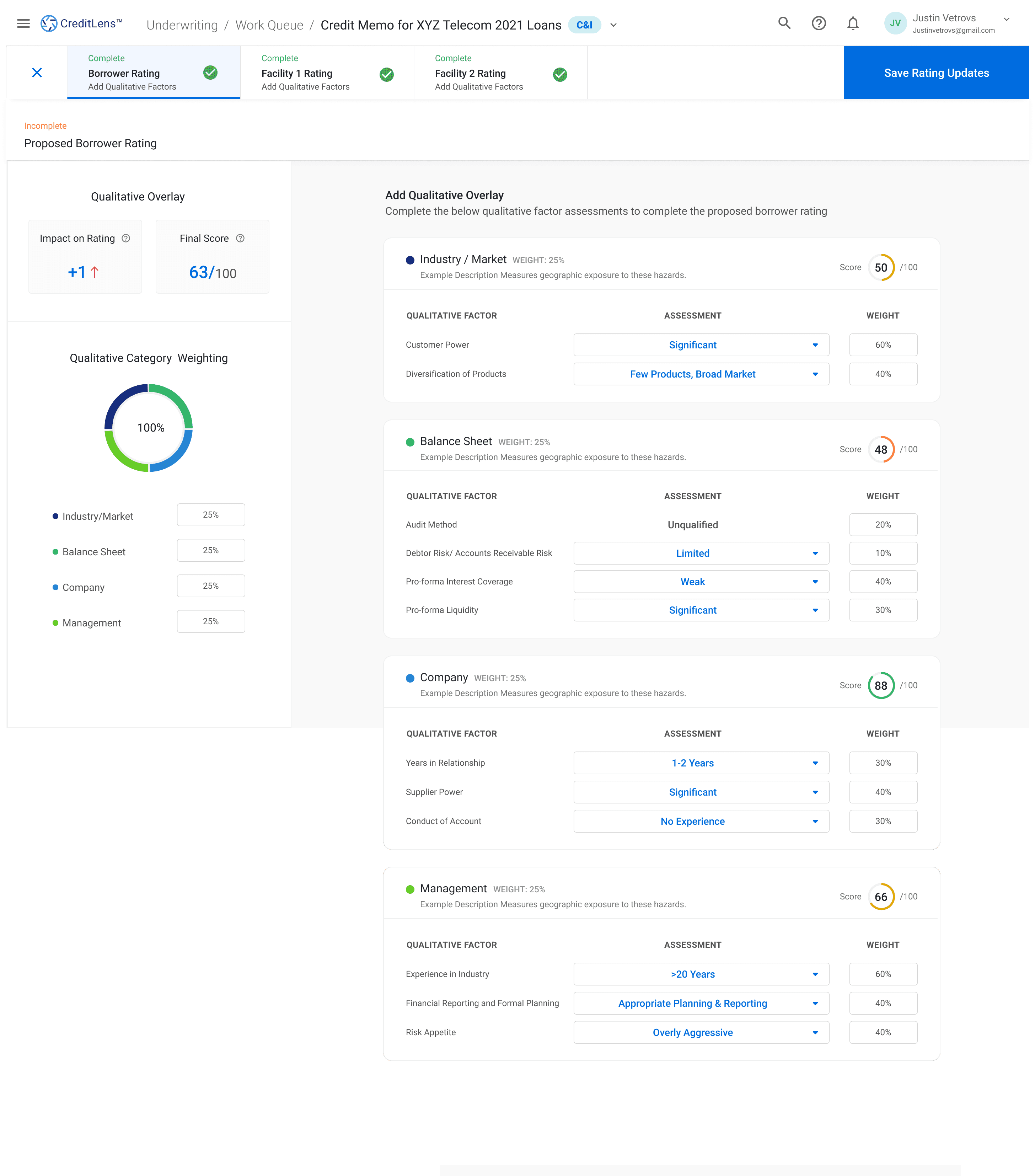

Automating Workflows

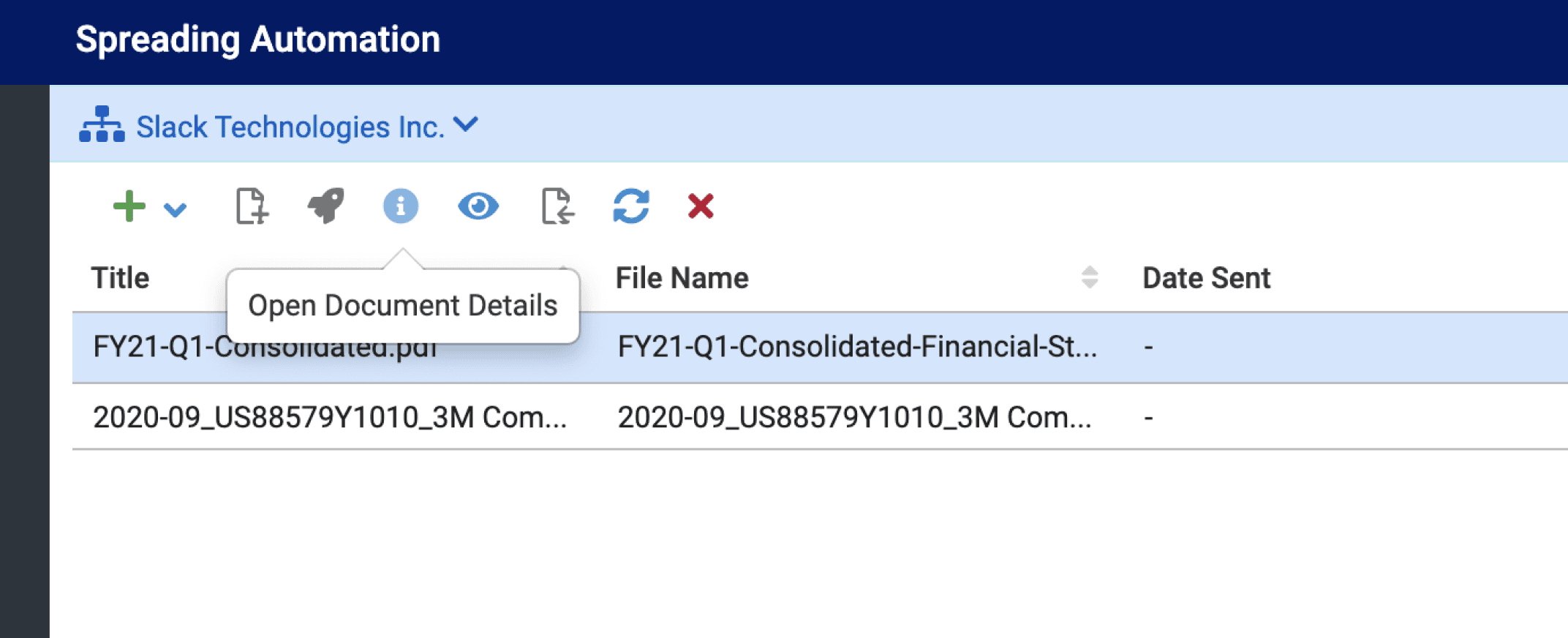

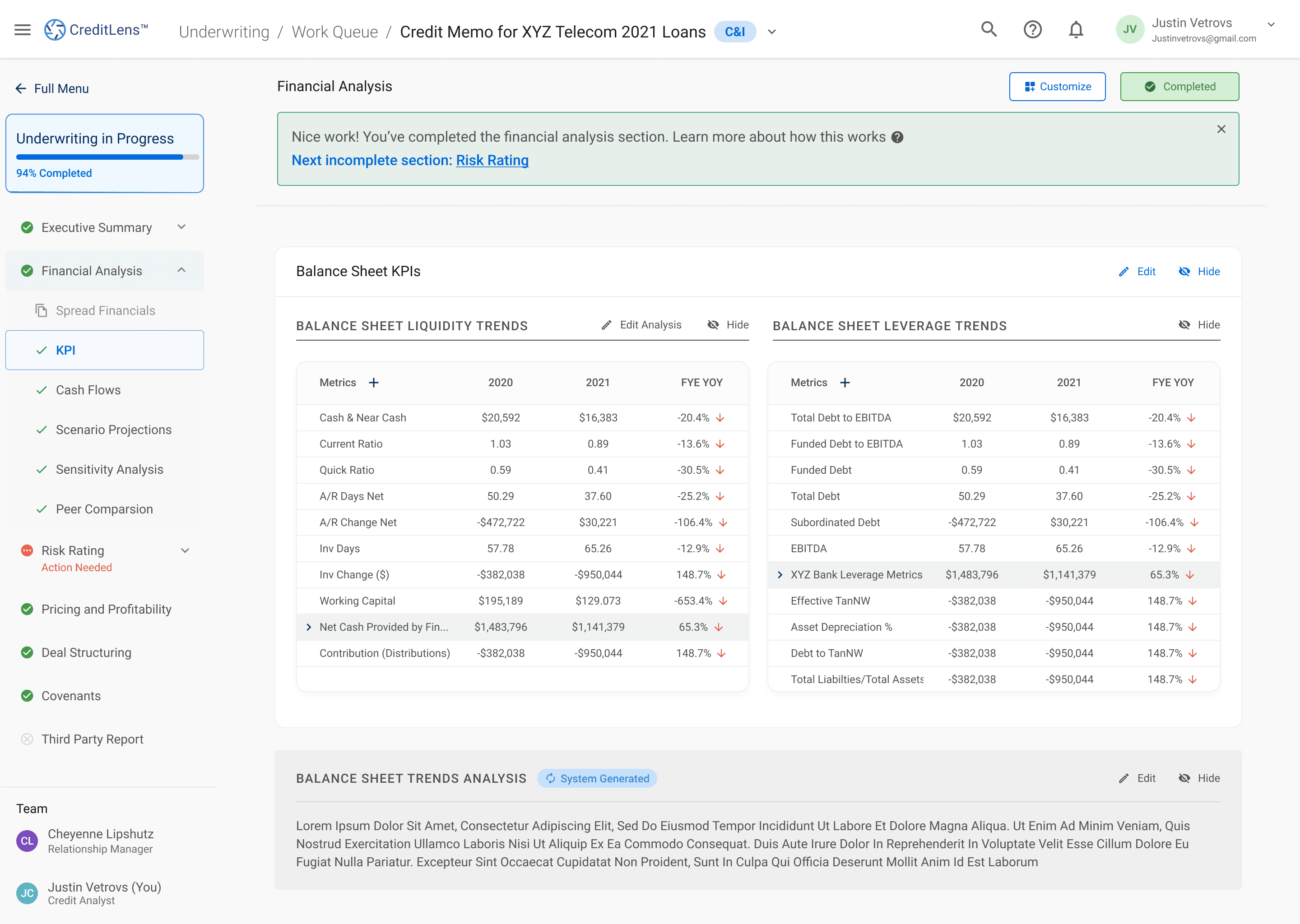

Integrating the right information at the right point in the process for the right persona will significantly impact the effectiveness of our users. Intelligently selecting the right workflows, surfacing assessment and risk data early, and providing a single point for data entry will allow users to focus on what is necessary for a project with a system that fills in as many blanks as possible.

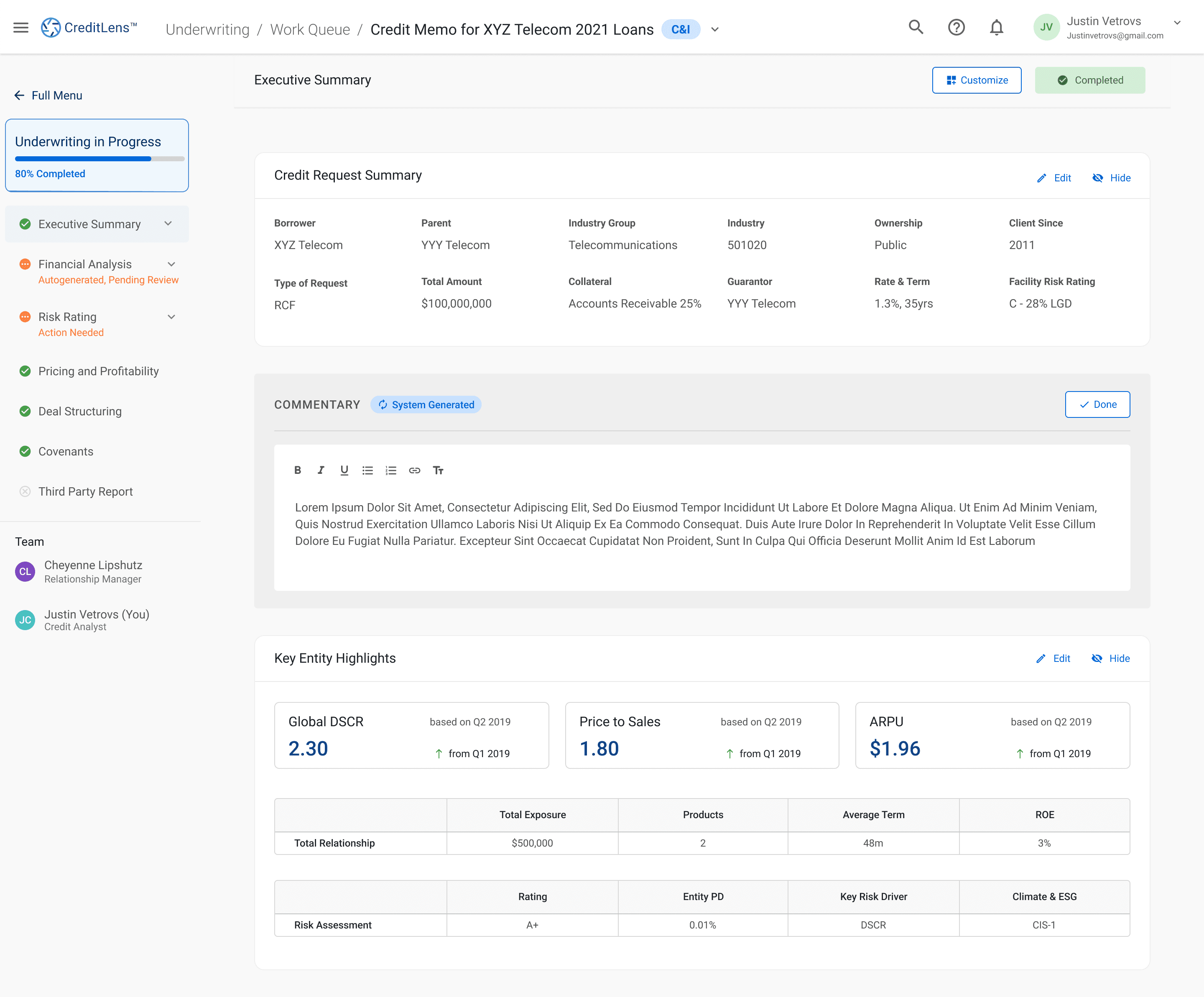

In this prototype, we allow the user to begin at the end : The underwriting process has been automated and prepared into a standard and customizable/configurable credit memo format. Now the user only has to come in to review and refine.

CreditLens system generates a complete credit memo based on available public data and requests private data available. This allows the user to save time by following their configurable credit memo template each workflow so they can directly begin reviewing and jump into any nuanced more complex underwriting.

AI Assisted Commentary & Analysis

Editable AI commentary to speed up productivity of underwriting

03

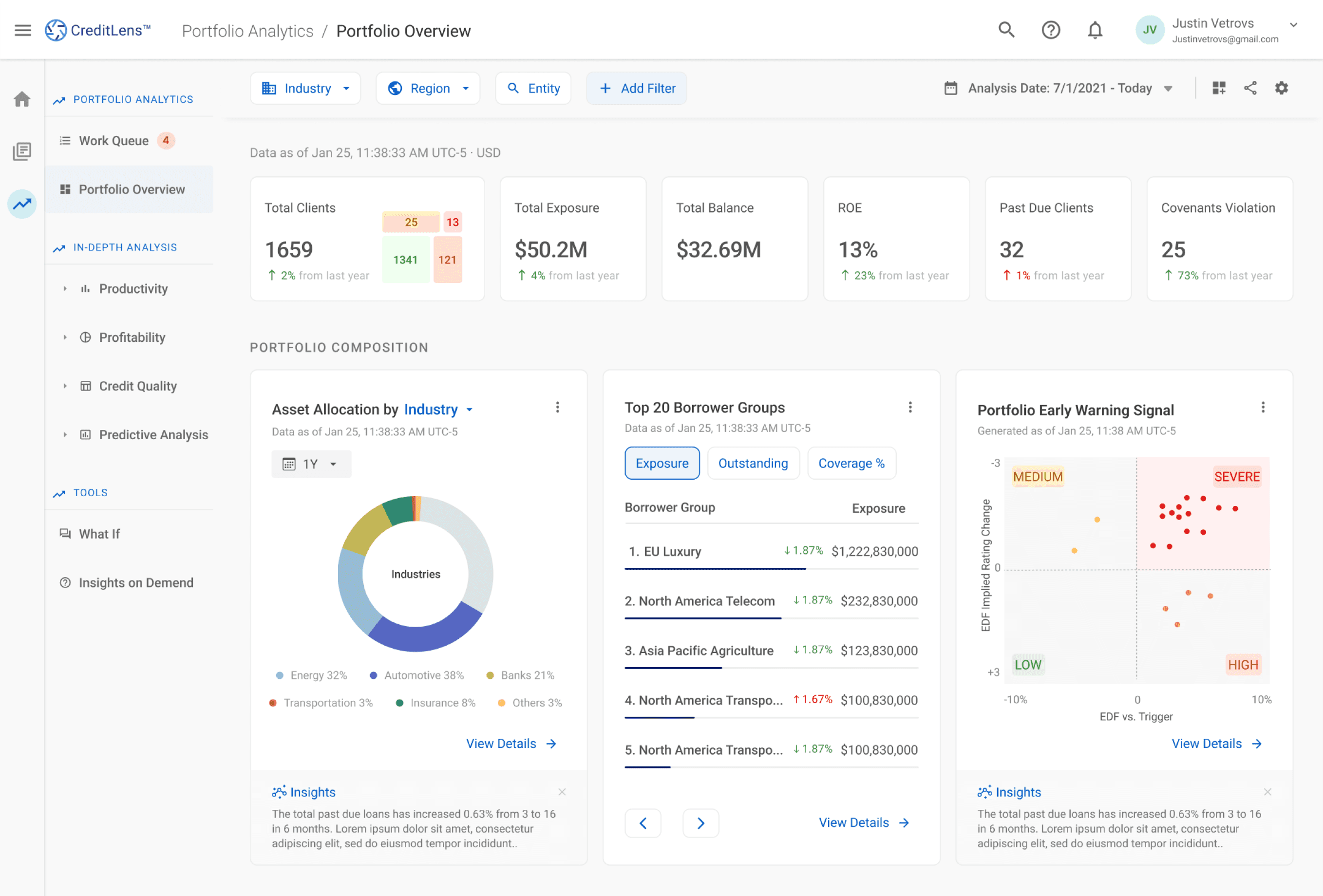

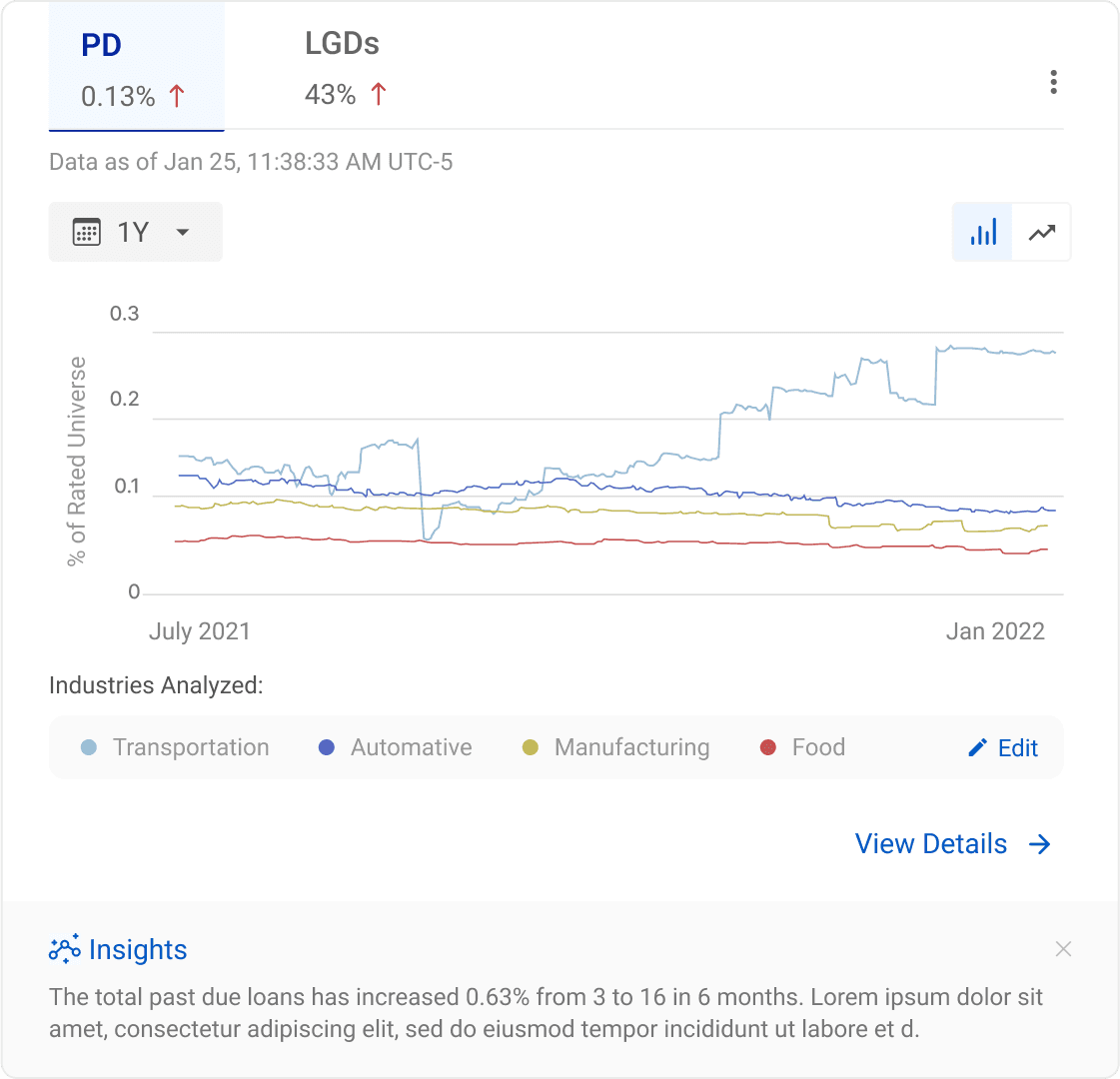

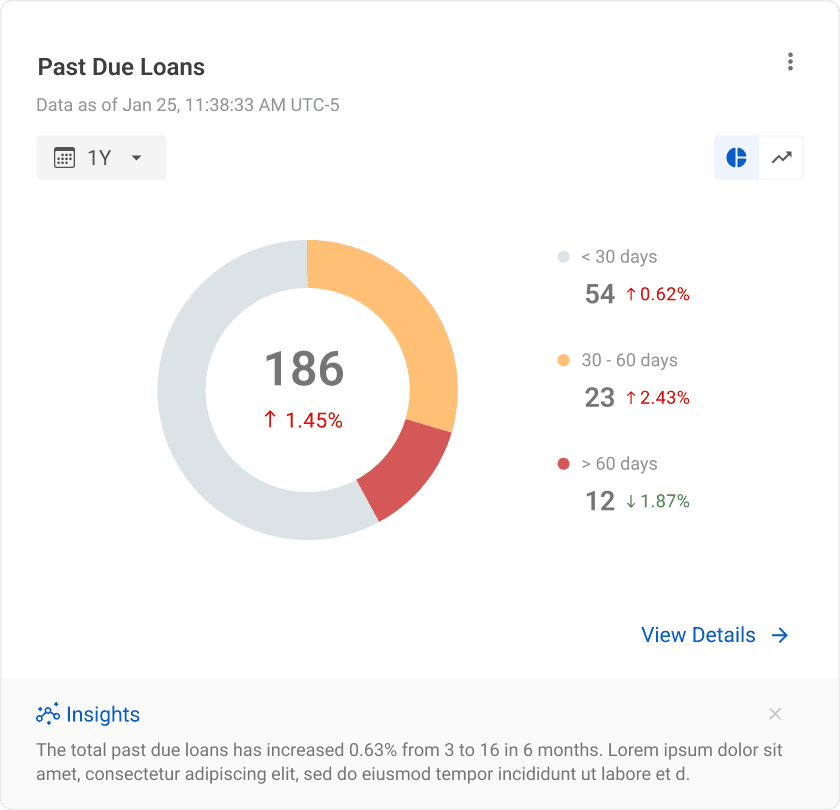

Data Accessibility and Transparency

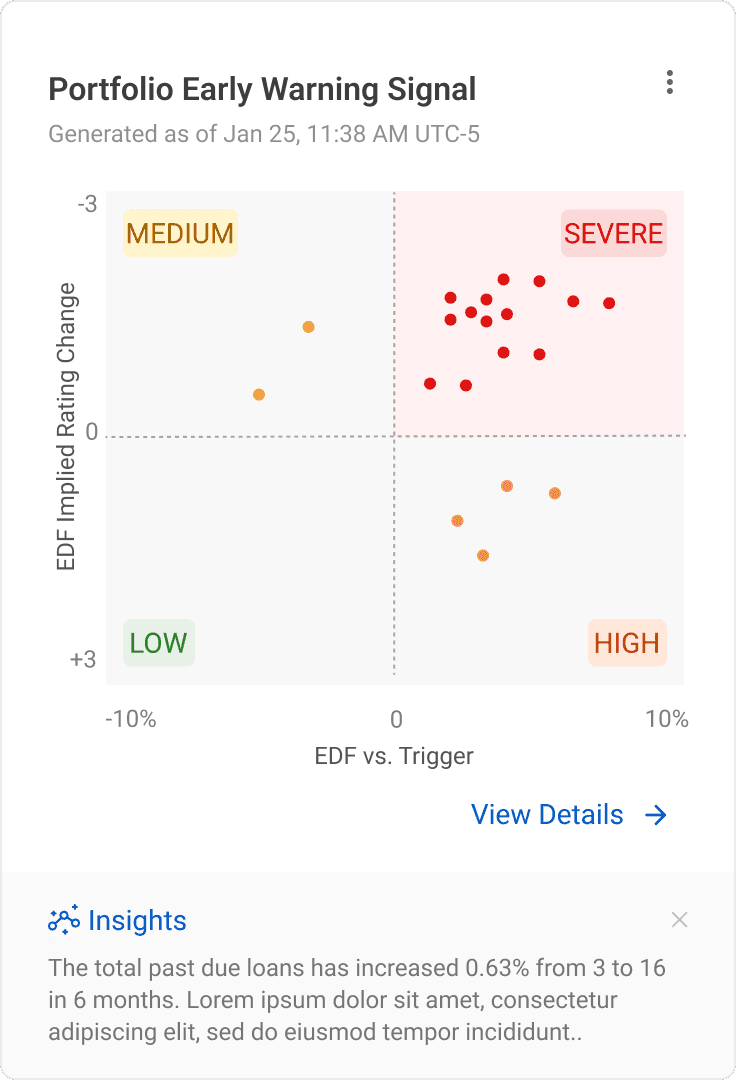

In our fast-paced and data driven world, having access to the right data at a moment’s notice can give Lenders and institutions a competitive edge. Through real-time insights, data curation, and reporting tools, CreditLens has the opportunity to provide practical value and reinvent itself to be a data engine that powers an institution’s entire lending process.

Data Accessibility and Transparency

Learnings and Next Steps

💡

Learning & Reflection

Navigating Complexity through Journey Mapping

Oftentimes the scope and complexity of this project could quickly become overwhelming - whether it is the sheer size of each workflow and persona or the complexity of the loan decisioning process and its data... We learned to trust in the design process and continued to build a shared asset of understanding together of everything we learned. Visualizing and making connections between the info we gathered led to a clear picture of the problem that eventually guided us to the solution.

💡

Learning & Reflection

Reading the Room and Adapting the Storytelling

As CreditLens was a high priority product that would impact many other teams and stakeholders within Moody’s, we would often have meetings and presentations with 30-40+ folks on a zoom - all from cross functional departments and different teams and products under Moody’s. This required thorough and proactive management of the purpose of each meeting, finding the background of each team, and probing within a conversation for different levels of understanding and what each stakeholder cares about to adapt the presentation and storytelling according.

⛳️️

Next Step

Usability Testing and Further Iterations & Refinement

The phase of work I completed led to full high fidelity prototypes based on our generative research - but as designers who care about our end user we would’ve loved to stay on to test and iterate the above solution design....

(Due to the nature of agency work and the structure of our team, we closed out this phase of the project and rotated other team members into the next phase of testing and iteration.)

⛳️️

Next Step

Expanding and Applying the Design Across More Industry Segments

We created this design solution based on our identified core customer segment : C&I lending (keeping in mind where it is similar or differs from other segments). However there are other major streams of revenue that come from other segments such as Agriculture or Commercial Real Estate that will require further discovery, research, and testing to adapt the solution for those segments.

Let's Chat!

li.vanessa.yh@gmail.com